The Basic Principles Of Thomas Insurance Advisors

Wiki Article

Facts About Thomas Insurance Advisors Revealed

Table of ContentsThomas Insurance Advisors Fundamentals Explained7 Simple Techniques For Thomas Insurance AdvisorsThe 6-Second Trick For Thomas Insurance Advisors8 Simple Techniques For Thomas Insurance Advisors

Your good health is what allows you to work, make money, and take pleasure in life. What happens if you were to create a significant ailment or have a crash without being guaranteed? You could locate on your own incapable to get therapy, or required to pay huge clinical costs. A research released in the American Journal of Public Health and wellness showed nearly 67% of people really felt that their clinical costs belonged to the reason for their insolvency." Not having coverage can be monetarily ruining to houses since of the high expense of care." Health insurance plan gotten with the Industry can even cover preventive solutions such as injections, testings, and also some appointments. By doing this, you can maintain your health and wellness and well-being to fulfill life's needs. If you're self-employed or a freelancer, you can deduct health insurance premiums you pay out of pocket when you submit your tax return.

5% of your adjusted gross revenue. Numerous specialists state that life insurance policy need to be a central part of your financial plan. How vital is it really? It depends on you. "The need for life insurance differs, as well as it changes gradually," clarified Stephen Caplan, CSLP, a monetary expert at Neponset Valley Financial Partners.

If they are accountable for sustaining a family members, making certain ample defense is crucial." If you're married with a family members when you pass away, what can life insurance policy do? It can change lost earnings, aid pay financial debts, or spend for your children's college education and learning. If you're solitary, it might spend for interment prices and also repay any kind of financial debts you leave.

About Thomas Insurance Advisors

Several professionals do not insure the chance of a disability," claimed John Barnes, CFP and also proprietor of My Family members Life Insurance. The Social Safety Management estimates that an impairment takes place in one in 4 20-year-olds before they get to retired life age.

Still, Barnes advises that worker's comp "does not cover off-the-job injuries or illnesses like cancer, diabetes, numerous sclerosis, or also COVID-19." The great news is that impairment insurance isn't likely to cost a fortune; it can commonly fit right into many budget plans. "Usually, the premiums of handicap insurance policy expense 2 cents for each dollar you make," said Barnes.

Some Known Factual Statements About Thomas Insurance Advisors

Identification burglary insurance covers any losses you might sustain if somebody swipes your identification. Long-term treatment insurance coverage covers you if were ever to require an assisted treatment facility, such as a nursing home or a rehabilitation center. Travel insurance coverage is normally a temporary policy that you acquire simply for the period of a journey, especially one outside of the U.S.

if you were to drop unwell or be hurt overseas. Umbrella insurance coverage covers you for responsibility over and also past your normal policies. If something happens outside your house that you may be responsible for however that your home or car insurance will not cover you for, an umbrella policy would certainly fill up that space.

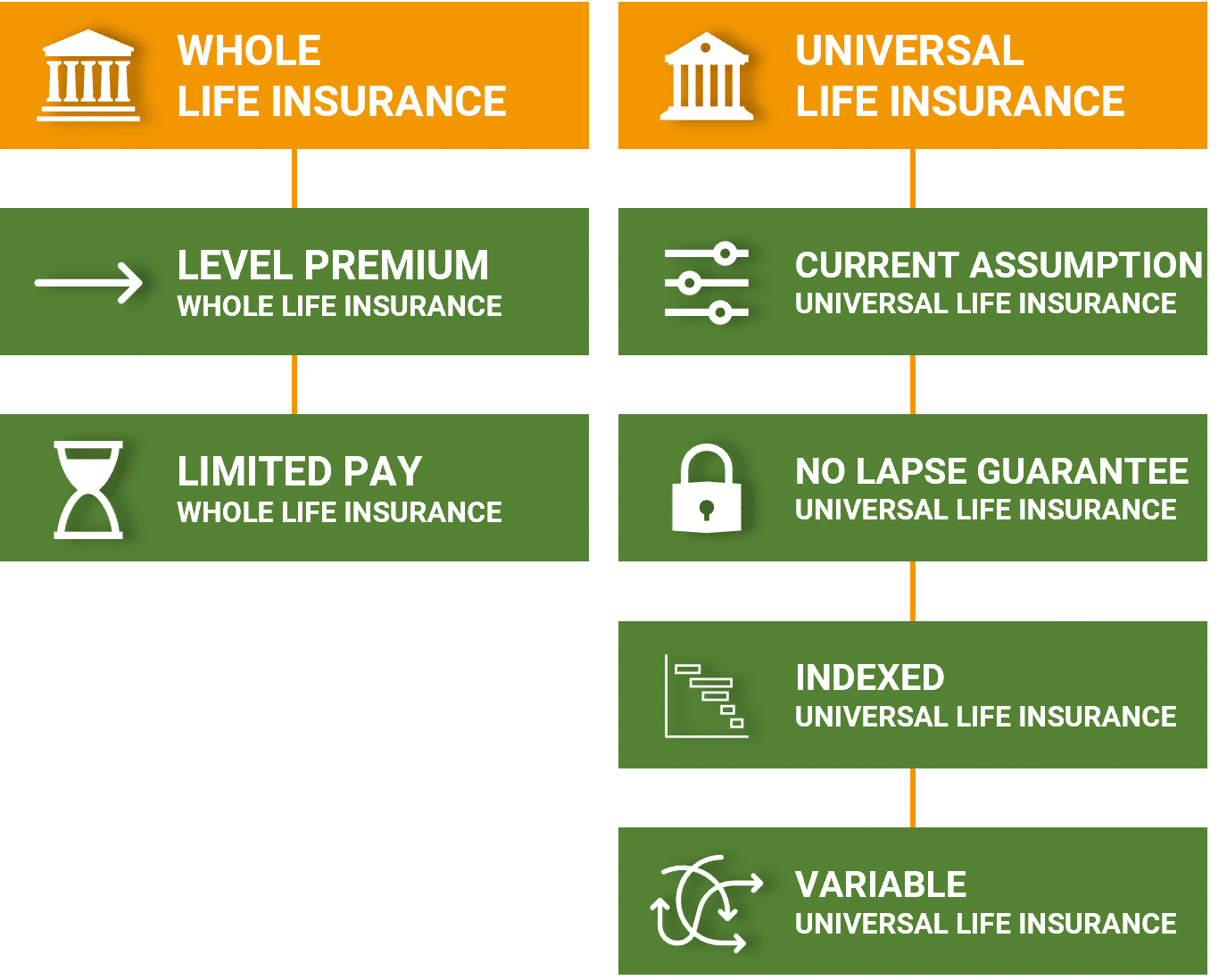

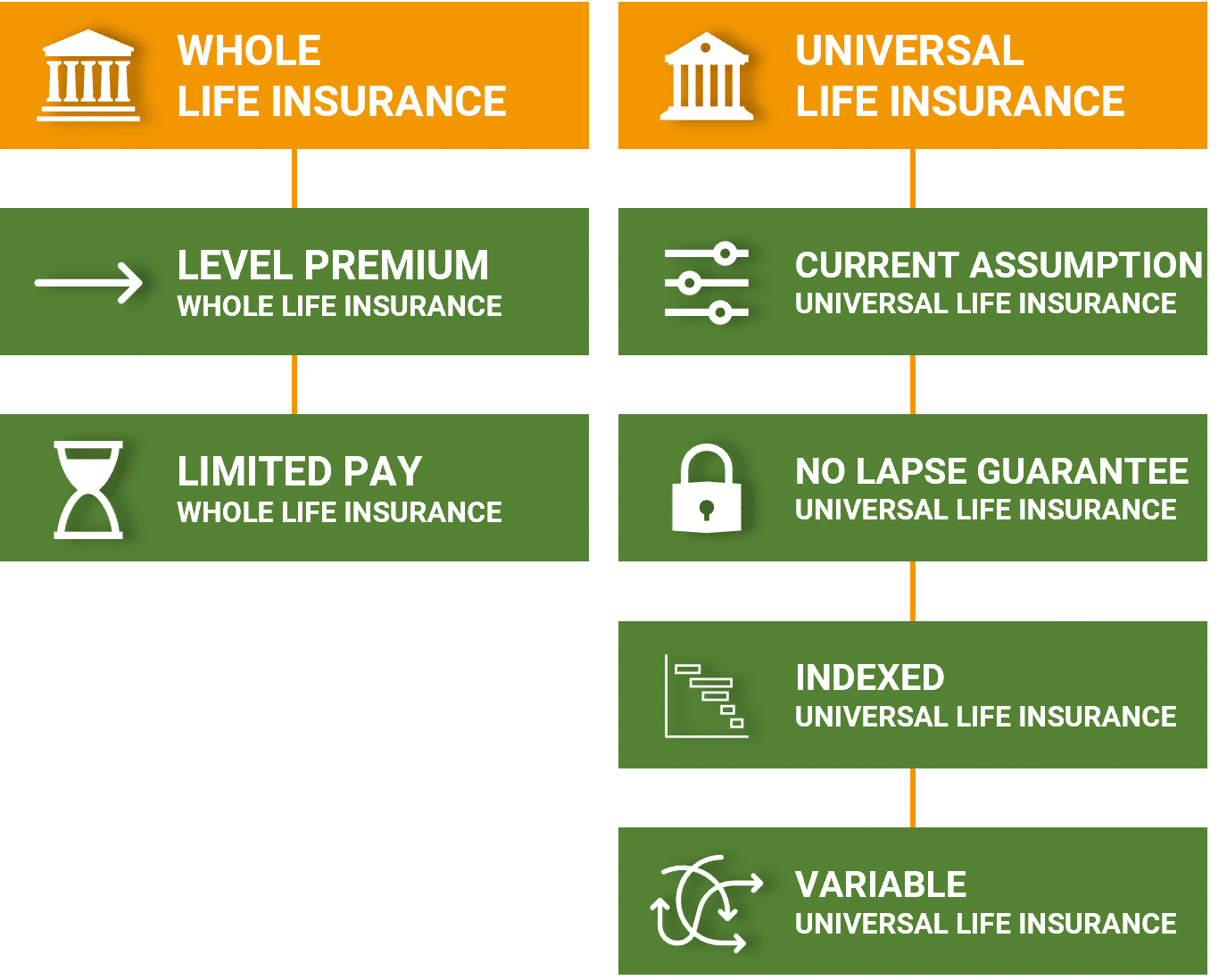

Entire life policies additionally reach a point where the insurance holder can pay out a section of the plan.

The 5-Second Trick For Thomas Insurance Advisors

Period: 6 minutes Discover the different sorts of insurance policy to assist you consider what you may and may not require. Wellness insurance/Supplemental medical insurance HSAs/Health Savings Accounts Special needs insurance coverage Life insurance policy Long-term treatment insurance coverage Estate planningVarious types of plans help you get as well as spend for treatment in a different way. A typical kind of insurance policy in which the health insurance will either pay the medical carrier directly or compensate you after you have actually filed an insurance coverage claim for each covered medical expenditure. Home Owners Insurance in Toccoa, GA. When you require medical attention, you visit the physician or hospital of your option (https://qfreeaccountssjc1.az1.qualtrics.com/jfe/form/SV_9yjulynEgxh4ZPE).

An FFS choice that enables you to see medical carriers who decrease their costs to the strategy; you pay less money out-of-pocket when you use a PPO carrier. When you visit a PPO you normally won't need to submit cases or documentation. Going to a PPO health center does not ensure PPO benefits for all solutions got within that healthcare facility.

Usually registering in a FFS strategy does not assure that a PPO will be readily available in your location. PPOs have a stronger visibility in some regions than others, and in areas where there are local PPOs, the non-PPO benefit is the basic benefit.

Report this wiki page